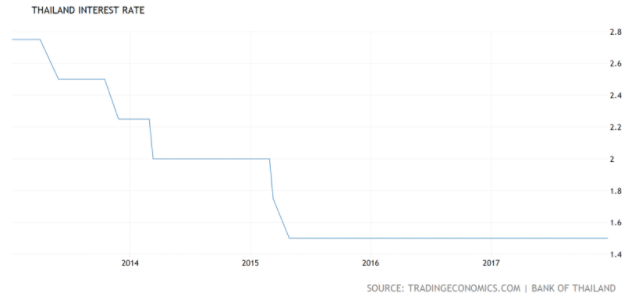

If you took out a home loan in the last 5 years, it is almost a certainty that your interest rate is higher than rates today. The chart below shows how interest rates from the Bank of Thailand have dropped since 2013, from 2.7% (this is the bank rate, home loan rates are higher) to the current level of roughly 1.5%. According to Masii.com research, 70% of home loans in Thailand today are at a higher fixed interest rate than the interest rate today. So should you refinance your home loan to a lower interest rate today?

First, it’s important to understand what it means to refinance. Let’s say that today you have a home loan to Siam Commercial Bank where you still owe 1,600,000 THB and your interest rate is 4.5%. Maybe you see that Thanachart Bank offers 2.5%. You will sign a document for Thanachart Bank to take over your 1,600,000 THB loan. Thanachart will pay 1,600,000 THB to Siam Commercial Bank to “buy” your loan. Now you owe the money to Thanachart, but at a lower interest rate of 2.5%. Your monthly payment will go down by a few thousand baht each month. Thanachart will charge you a fixed fee upfront to do the refinancing.

How much can you really save?

The average family condominium in Bangkok costs about 7.5 million THB. If you can lower your interest rate by just 0.2% (say from 4.5% to 4.3%), you would save 313,000 THB during the life of the loan. On average, interest rates in Thailand have dropped by 1.5% since 2013, so you could save well over 1 million THB by refinancing your home loan.

The downsides of refinancing

The biggest downside to refinancing a mortgage is that you “restart your home loan clock” which means the ratio of principal to interest paid goes back to day one.

What does that mean?

Every month when you pay off a home loan, a percentage of your money goes toward your principal (the total amount you still owe the bank) and another percentage goes to the bank in the form of interest. When you first start paying off your home loan, the vast majority of payments are interest – up to 80%. That means if you pay 10,000 THB per month, 8,000 of it goes directly into the bank’s pocket, and only 2,000 gets credited toward your balance. Later on in your loan, say year 20, the ratio is flipped – 80-90% of your 10,000 THB goes toward paying down your balance, and the remaining 10% goes to paying interest.

When you refinance, you start over from zero, meaning that the majority of your payment will again be toward interest and not principal. If you are early in your loan (the first 5-10 years) this is not such a big deal, but if you’re 20-25 years into your loan, you might want to reconsider

The final word

If you’re one of the millions of Thais who took out a home loan in the past 5 years, you can benefit greatly by refinancing. The costs are low and the benefits can be in the millions of baht. Use Masii.com’s helpful tool to see how much you can save by refinancing your home loan today.